457 Plan Limit 2025. The following limits apply to retirement plans in 2025: 457 plan contribution limit for 2025 rises to $20,500.

The irs has announced the 2025 contribution limits for retirement savings accounts, including. In 2025, you can put up to $19,500 per year in a 457 (b) plan ($20,500 in 2025), though total contributions (including from your employer) can’t be more than your.

What Is a 457 Plan? Defintion, Types & Benefits, Find out how much you can save for retirement. Employees age 50 or older may.

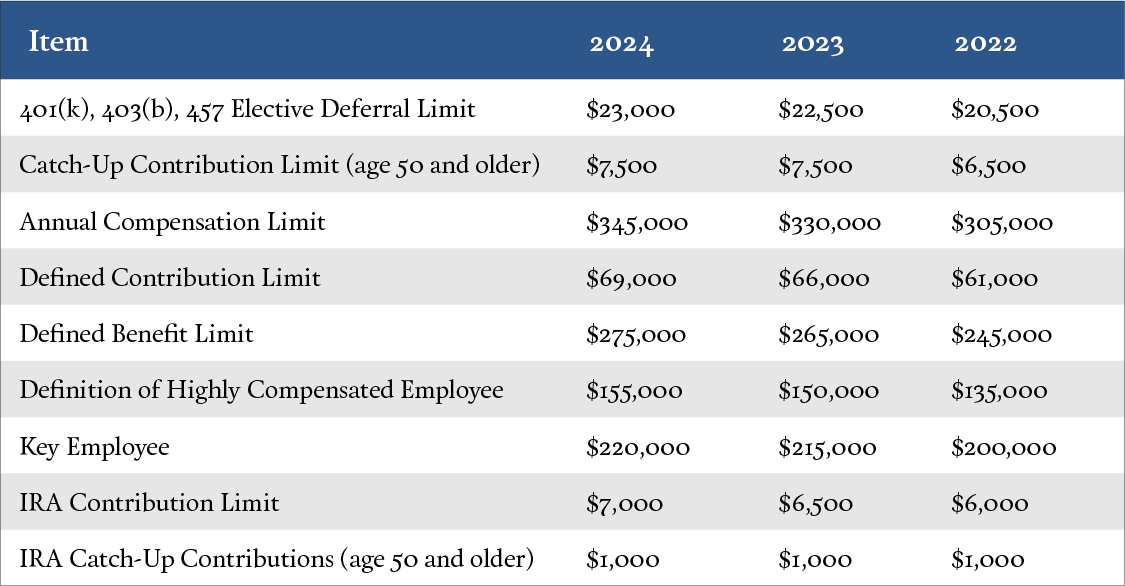

457 Plan, The contribution limits for 401 (k), 403 (b) and eligible 457 plan elective deferrals and for designated roth contributions are projected to rise to $23,000 in 2025. If you're 50 and older and participating in 401(k), 403(b), and most 457 plans, here's some news:

:max_bytes(150000):strip_icc()/457plan.asp-final-f27170b983d0496e86a246a0c1cb4602.png)

Significant HSA Contribution Limit Increase for 2025, Reviewed by subject matter experts. The irs modestly increased the applicable limits for 2025.

Understanding 457 Plans Scarlet Oak Financial Services, Find out how much you can save for retirement. The irs has announced the 2025 contribution limits for retirement savings accounts, including.

457 Catch Up For 2025 Gaby Pansie, Review the irs limits for 2025. The contribution limit for employees who participate in a 457 (b) plan , 403 (b) plan, or the federal government’s thrift savings plan is $23,000 in 2025 (up from $22,500 in 2025).

457 Calculator (2025), 457 (b) contribution limits will increase from $22,500 to $23,000 in 2025. The irs has announced the 2025 contribution limits for retirement savings accounts, including.

2025 457 contribution limits Inflation Protection, The maximum amount you can contribute to a 457 retirement plan in 2025 is $20,500, including any employer contributions. Employees age 50 or older may.

457 plan What Is a 457(b) Plan and How Does it Work? styleveer Finance, That’s an increase of $1,000 over 2025. If you're 50 and older and participating in 401(k), 403(b), and most 457 plans, here's some news:

Irs Limit 2025 Liuka Rosalynd, Retirement planning » qualified retirement plans » 457 (b) plans. The irs modestly increased the applicable limits for 2025.

401k 2025 Max Contribution Limit Irs Sybil Euphemia, Limit increases to $23,000 for 2025, ira limit rises to $7,000 The maximum amount you can contribute to a 457 retirement plan in 2025 is $20,500, including any employer contributions.